- Next Free Webinar: Spanish Golden Visa for Investors

Contact us for further information

Our taxes services

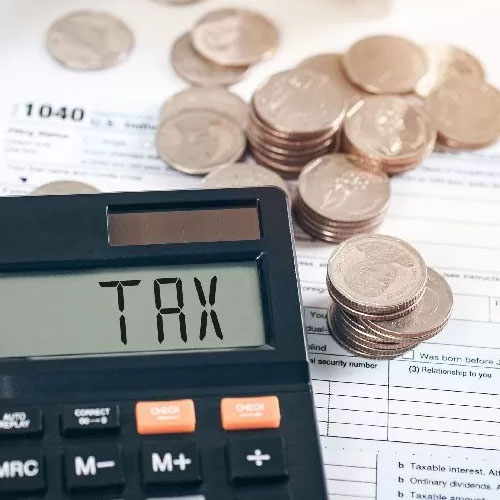

Model 720

If you are a tax resident in Spain, i.e. you have been resident in Spain for more than 183 days during a calendar year, you must inform the Spanish tax authorities of your assets and rights located abroad.

La Renta in Spain

Are you in Spain for more than six months (183 days) of the calendar year, or are your core economic interests in Spain? If the answer is yes, then you are considered to be a tax resident in Spain.

Wealth Tax in Spain

The Wealth Tax in Spain is an annual tax, payable on the total net value of your assets held on 31st December.The rules vary depending on your residency status in Spain and the region you are in.

International Tax Planning

The main purpose is to avoid a natural or legal person being taxed in two different countries for the same concept (e.g. personal income tax) or an asset being taxed for the same concept in two different countries.

Non Resident Tax in Spain

This tax applies to anybody who is not legally a resident in Spain, but who has assets in Spain, such as property, income from the rental of property, income from bank deposits when applicable, royalties from intellectual property...

Spanish Inheritance Tax

The Spanish Inheritance Tax is a tax on the goods of someone who has passed away, just like in many other countries. This tax includes property, money and any other kind of assets. Is totally different in Spain and in the UK.

Calculation Inheritance Tax

From the experience gained by working for more than 20 years in the legal sector, we have identified the needs of our Europeans customers, to know the inheritance tax payable by their beneficiaries when they inherit.

Pellicer & Heredia

Taxes Department

We manage and process all Legal and Administrative aspects of Taxes in Spain. Among other services, we offer the following:

- Model 720

- La Renta in Spain

- Wealth Tax in Spain

- International Tax Planning

- Non Resident Tax in Spain

- VAT number Spain

- Personal Taxes

Services development

PELLICER & HEREDIA LAWYERS manage and process all Legal and Administrative aspects of Taxes in Spain.

llicer & Heredia, with offices throughout the Costa Blanca, has expert tax advisors that provide a comprehensive service of advice and planning of the annual personal income, prior to the end of the calendar year to optimise the minimum payment of taxes.

Furthermore, weeks before the start of the declaration period (April-June) our main concern is that all of our clients, prior to granting their consent, receive a reminder about the tax campaign, among other publications of interest. Together with these notifications, our advertising team attaches a useful form, and a questionnaire, drawn up in several languages, that the client of interest can fill in with their personal and financial data, in order to prepare the standard declaration.

Once the rental campaign has begun, appointments to meet with the advisor are made, where the information on the previously prepared declaration will be checked thoroughly, prior to it being filed.

Our main premise is that our service approaches long-term foreign nationals residing in Spain, or have properties or business here.

On this basis, if you have any doubts on when you should present your tax declaration, whether you are obliged to do so, or if you wish for the advisor to directly remind you of the dates, please contact Pellicer & Heredia today, and don’t waste any more time. We will keep you up to date with the latest information for your peace of mind.

Let's inform you

Real Stories

Know our customers stories

Pellicer & Heredia specialise in Taxes & International Law and have many years of experience, giving you peace of mind your application will be dealt with great attention to detail and, most of all, personal attention, always seeking the best option for you.

It doesn’t matter where you are from or what language you speak; Pellicer & Heredia is with you every step of the way.

Pellicer & Heredia specialise in Taxes & International Law and have many years of experience, giving you peace of mind your application will be dealt with great attention to detail and, most of all, personal attention, always seeking the best option for you.

It doesn’t matter where you are from or what language you speak; Pellicer & Heredia is with you every step of the way.

Additional services

Buying a property in Spain

Pellicer & Heredia has a dedicated Real Estate Department, providing expertise in all legal aspects of the conveyance process and issues relating to contracts, rental contracts, mortgage floor rates, off-plan properties, buying properties through the courts, etc.

Golden Visa

Is a great opportunity to establish a home or residence in Spain. Gives permission to reside and work in the whole territory of Spain, but the applicant is not obliged to be in the country for more than 6 months a year to be able to renew the residence.

Non lucrative Visa

The non-lucrative visa is for non-EU nationals who wish to reside in Spain, but are not planning to undertake any type of professional activity. This residency permit authorises their holders and their families to live in Spain, allowing them to move freely within the EU.

NIE number

The law in Spain requires foreign nationals to obtain a NIE number (Número de identificación de Extranjeros) for various transactions, such as purchasing or selling a property, applying for a mortgage, buying a car, paying taxes, etc. There are different ways of applying for it.

Where we are

- Alicante (headquarters)

- Jávea

- Dénia

- Moraira

- Petrer

- Hondón de las Nieves

- Ciudad Quesada

- Mojácar

- Almería

- Marbella